what is a tax provision account

Initial impressions of corporate alternative minimum tax provision in draft Senate reconciliation bill. Once tax calculations have been worked out the company can enter the tax provision in its accounting books.

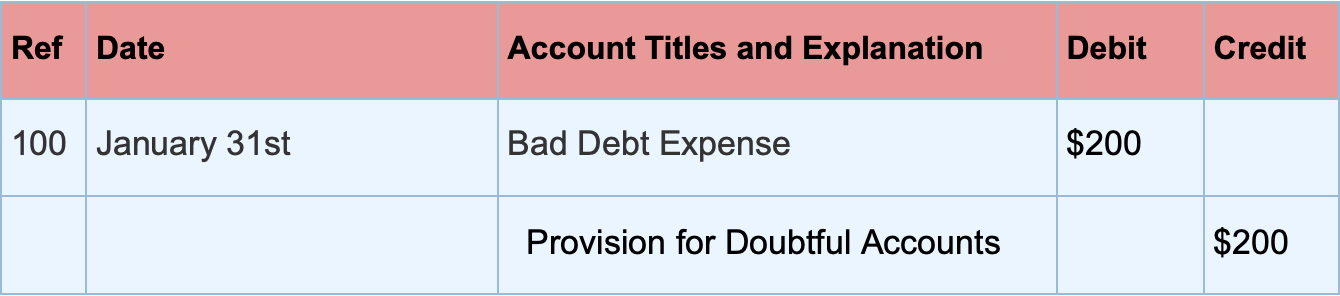

Deferred Tax Asset Journal Entry How To Recognize

VAT Control- As you.

. When you process the sale or purchase the system needs a holding account to accumulate the potential or provisional tax amount. Tax deductions can include meals interest expenses depreciation allowances holiday parties and more. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

Other types of provisions include accumulated depreciation guarantees warranties income tax accrued expenses. In financial accounting under International Financial Reporting Standards a provision is an account that records a present liability of an entity. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense.

Accounting entry will be as under. Bookkeeping and accounting use the term provision meaning an estimated amount set aside when it is probable that a liability has been incurred or an asset impaired. A tax provision is an estimated amount a business sets aside to pay for its income taxes.

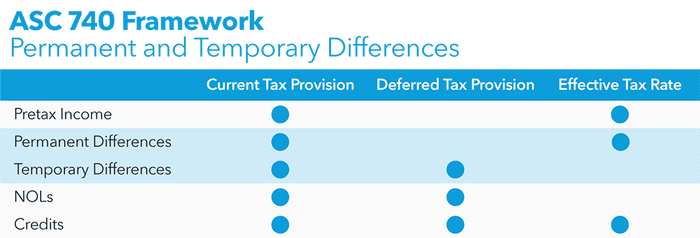

Tax provisioning involves calculating the current and deferred value of tax assets and liabilities. They appear on the companys balance sheet under the current liabilities section of the liabilities. When you process the sale or purchase the system needs a holding account to.

Still the carried-interest tax provision was a relatively small part of the Inflation Reduction Act. There are many reasons why a business would want to create a provision in its accounting. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

VAT Provision- tax becomes due or claimable only when you receive or make the payment. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary. The recording of provisions occurs when a company files an expense in the income statement and consequently records a liability on the balance sheet.

By their very nature provisions are estimates of probable loss related to the future for. What Are Tax Provisions. The amount of the said provision of Income Tax is mainly calculated using the firms reported net income in addition to other relevant income tax rates that are applicable.

The provision in accounting refers to an amount or obligation set aside by the business for present and future obligations. Generally Accepted Accounting Principles a provision is an expense. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences.

The Provision in Accounting Meaning The provision in accounting refers to an amount or obligation set aside by the business for present and future obligations. The company makes this provision by making adjustments to the difference of permanent as well as the temporary nature in the companys net income for the period. Lawmakers estimated the provision would generate about 14 billion over 10 years compared.

Typically provisions are recorded as bad debt sales allowances or inventory obsolescence. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Provision for Income Tax refers to the provision which is created by the company on the income earned by it during the period under consideration as per the rate of tax applicable to the company.

In practice the issue concerning provisions for assetsliabilities and contingent assetsliabilities can be a confusing one. Care needs to be taken to not only account for provisions and contingencies correctly but also to recognise any provisions at an appropriate amount. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

A tax provision is set aside to pay your companys income taxes which are calculated by adjusting gross income by claimed tax deductions. The provision of income tax is defined as the estimated amount that a business or an individual taxpayer expects to pay in terms of income taxes in the given year. Tax provisions are an amount set aside specifically to pay a companys income taxes.

The recording of the liability in the entitys balance sheet is matched to an appropriate expense account on the entitys income statement. Another type of provisions in accounting to be aware of relates to taxes. How do you calculate tax provision.

In order to calculate the tax amount owing a business needs to adjust its gross income by the amount of tax deductions it is claiming. Whats the Difference Between Provisions and Reserves. What Are Tax Provisions.

It is a contingent loss that is recognized as a liability. Provision Definition in Accounting. The provision is unpopular.

A tax provision safeguards your business from paying penalties and interest on late taxes. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. Tax provisioning involves calculating the current and deferred value of tax assets and liabilities.

What are tax provisions. A tax provision is set aside to pay your companys income taxes which are calculated by adjusting gross income. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Add or subtract net permanent differences. The amount of this provision is derived by adjusting the reported net income of a business with a variety of permanent differences and temporary differences. The amount of this provision is derived by adjusting the reported net income of a business with a variety of permanent differences and temporary differences.

Particularly where there may be associated tax implications as HM Revenue and. The adjusted net income figure is then multiplied by. As previously reported Senator Joe Manchin D-WV on July 27 2022 announced that he had reached an agreement with Senate Majority Leader Chuck Schumer D-NY on tax climate change energy and health care.

What is a tax provision.

Define Deferred Tax Liability Or Asset Accounting Clarified

What Are Provisions In Accounting

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Define Deferred Tax Liability Or Asset Accounting Clarified

Provision For Income Tax Definition Formula Calculation Examples

Provision Expense Types Recognition Examples Journal Entries And More Wikiaccounting

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Define Deferred Tax Liability Or Asset Accounting Clarified

The Provision In Accounting Types And Treatment Tutor S Tips

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Provisions In Accounting Meaning And Types

What Is A Tax Provision And How Can You Calculate It Upwork

Provision Expense Types Recognition Examples Journal Entries And More Wikiaccounting

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

The Provision In Accounting Types And Treatment Tutor S Tips

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)